Investment in Canadian agrifoodtech has grown tremendously in the past decade, attracting over CAD $4.1B since 2014. Agrifoodtech is a broad classification, referring to everything from precision fertilization systems to food delivery robots, but it can be broken down into two general categories: agtech—technology innovation that occurs on the farm, and foodtech—technology innovation at every other step in the food value chain, which includes processing/manufacturing, retail, wholesale, and foodservice.

Investment Dynamics: Foodtech vs. Agtech (2014-2024)

The potential for technology to inspire widespread sector growth in Canadian agrifood is profound. In the past decade, investors have noticed this potential—at least on the “ag” side of the agrifood sector.

Relative to global investing norms, Canadian agtech punches above its weight while foodtech lags behind. These charts illustrate that, despite the distribution of Canadian companies classified as either agtech or foodtech tracking closely to global averages, distribution of investment across the two categories does not:

Rather than reflecting an over indexing of agtech innovation at the expense of foodtech, these figures illustrate an overall foodtech investment gap. As one of the world’s leading agricultural producers, Canada can and should be investing heavily in on-farm innovation to drive advances in production efficiency, sustainable land management, and climate resiliency. But our relative underinvestment in the post-farmgate or “value-adding” segments of the agrifood sector is considerably slowing the growth potential for one of the country’s largest, most consequential industries.

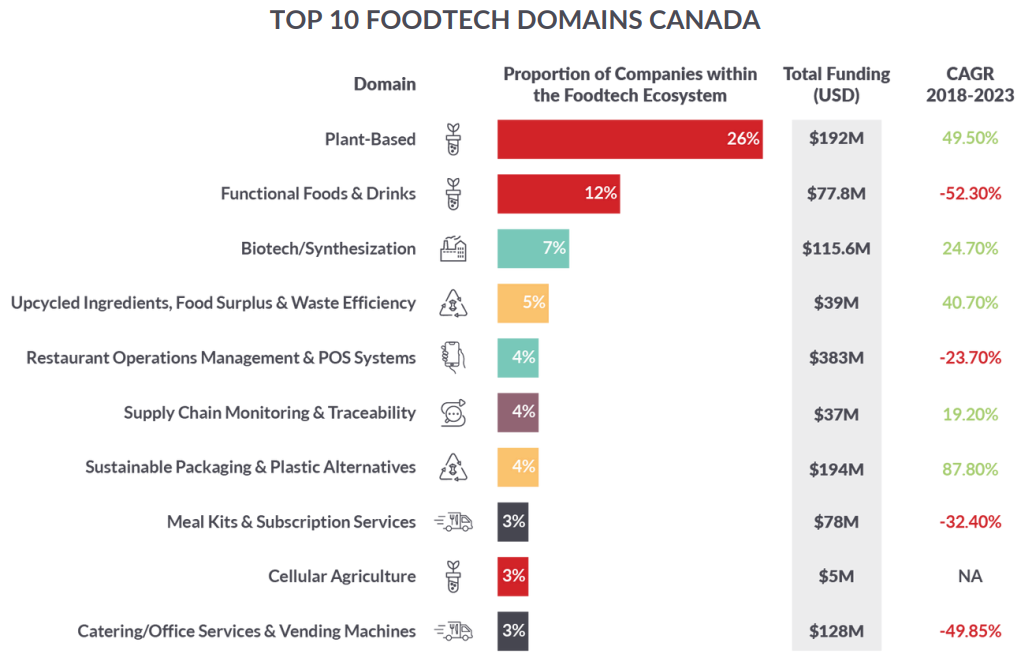

Where Foodtech Funding is Flowing

Although this gap in investment capital continues to limit the overall maturation of Canada’s foodtech ecosystem, there are certain innovation areas where Canada is emerging as a global leader.

Note: Sustainable Packaging & Plastic Alternatives is mostly driven by publicly listed outlier company Good Natured with $133M raised to date.

Note: Sustainable Packaging & Plastic Alternatives is mostly driven by publicly listed outlier company Good Natured with $133M raised to date.

Above are Canada’s top 10 foodtech domains, ranked by the number of companies operating in each domain. Looking at the compound annual growth rates (CAGR) from 2018-2023, Canada is outpacing global averages in a few key categories: Plant-Based, Biotech/Synthetization, and Upcycled Ingredients.

What is Canada doing to succeed in these foodtech domains? And what is needed to sustain and build on that success across the entire ecosystem? You will find answers to those questions, and even more insight into the economics of Canadian foodtech, in CFIN’s new Foodtech in Canada 2025 Ecosystem Report. Read the full report here.